Seems like a basic place to start and that is the point. It’s surprising the amount of people that don’t spend a little bit of time each month sorting out their budget, and then wonder where all their money is going, or why they are in over their heads.

Before we begin there are two points to make, the first being that I am not a licensed financial advisor, though I have worked in Finance as both a Compliance Officer and previously in Private Equity Sales. My knowledge is good enough I would say, but don’t consider this official financial advice. As well it is not actual proper accounting, I find that dry and boring. Its just something anyone can get in the habit of doing or thinking about, to help yourself manage finances. Its especially good if you are NOT a penny pincher and seem to loose track of where your money goes. Ahem, me, without a budget.

Secondly, and since we are taking baby steps, its important to note that the following post does not take into consideration investment calculations so it is not a true representation of your net worth, or debt. Its a broad overview of how to work with your net pay, which is your after-tax, in hand dolla dolla bills. If like me, you’ve been confused as to which one is before tax and which is after, a way that I’ve remembered it is to think; Gross pay means its “gross” what they take from you ie. taxed amount, and Net Pay is what is caught in the “Net” after the shakedown, or aftertax. Probably not found in textbooks, its just what I’ve committed to memory.

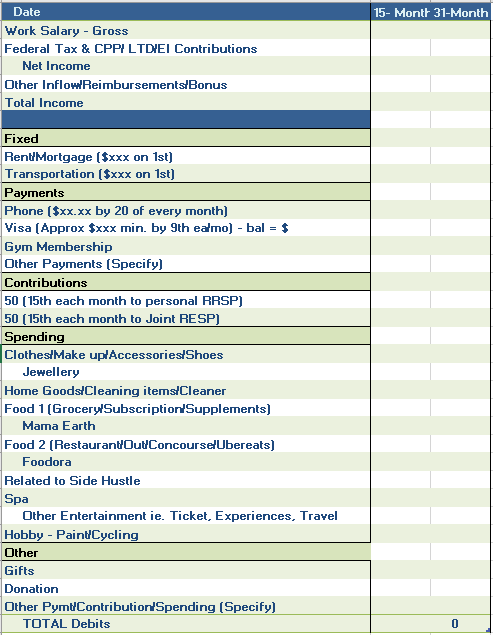

This is further assuming a regular influx of money, or cash flow. Its best applied to a salaried job as your budget becomes more complex if you have irregular or inconsistent income. In any case its still manageable and you may or may not find a couple of useful points to adapt to your unique budget. As an overview, it could look something like this:

So where do we start? With the necessities or what I call non-negotiables. I like to write it out in a notebook so I can always see in hand what I’m dealing with, in addition to an excel sheet. But you don’t have to be as archaic as me; a simple excel or word doc will work too. Whatever you choose, its important to stay accountable to yourself, and not ‘cheat’ by allocating an unreasonably low amount to your entertainment funds, which you know for a fact you can’t stick to. This will render your budget useless. If you like to go out at least twice a week, placing $20 next to discretionary will simply not cut it and you’ve lost the plot before you’ve even begun implementing it for the month. Its just preposterous. That’s the cost of one drink in most places downtown. And if you go out a lot, you should really just have a separate category for ‘drinks’. Moreover if you smoke anything like vapes, ciggies or weed, be real. Accept that you haven’t quit yet, and make that a separate category under ‘fixed’. The less you lie to yourself the better off you’ll be. This is for you.

Anyway, necessities include shelter, food, transport and in our day and age, phone. Food is tricky and transport can vary, so lets first address shelter. Where ya gonna live? Do you have a roommate or partner to share the costs with? This is the simplest factor because its a set amount each month. If you’re downtown TO, can you spare yourself the transit cost and locate yourself within walking or biking distance to your work? Back when I was broke worse than poor Timmy asking Scrooge if he can please have some more, this is what I did and today I pat myself on the back for it. As a rule of thumb, your housing cost should not exceed 50% of your total net pay. If you’re in TO or other other major city, ha-ha-hah. Good luck with that. Really. We will talk about air bnb later, but for now interject only your actual set income to this equation. So, all that to say….

FIXED

Housing. For simplicity, if you clear $4000 a month, or $2000 bi weekly, and your rent or mortgage is $2000, you’re going to need to have money from the pay before, or savings to stretch over the month. Don’t just take your mid month pay and blow it all in one night. (granny says “don’t spend it all in one place”). But its true. You’ll be eating air for the month if that’s the case. Oh well, maybe better for the figure some times.

Transport. Accurately calculate what you will spend on public transit like TTC pass, GO pass, Uber, Lyft or cabs by establishing how far you are from work, and if you meet friends out. If you have a car, have a separate category for insurance, maintenance, car payments and ‘unknowns’ like maybe a new battery, or car exploded, need new engine. Then, factor in parking costs in green P or underground at work. I also used to have a special category for ‘tickets’, because that’s just me. I’ve grown since then, but I was never in denial. If one of my brilliant illegal parking spots didn’t slip under the radar of our ever fastidious car ticketing professionals, then I had to pay the $60 -$300 hit. Its not responsible, but it is what it is. We can’t all be perfect. How many fire hydrants are there anyway? Seems like one every five feet. Oh, and make sure to fully place your car behind the pole with the sign on it. Those busy bodies prey on getting you for the fact that the trunk of your car is over the pole, even by a hand. Eventually I got rid of the car but I needed it as parents were in another city and not easily accessible by transit. Some people also need to drive around for work. Or find its actually cheaper than all the uber rides. If you find that a car is something you need, take into consideration all foreseen and unforeseen costs associated to this money pit.

Payments & Subscriptions

Phone & Wifi. Most carriers today will cost an average of $80-$100 for a good plan that is unlikely for you to run over and collect fees. You pay your phone off with each new 2 year renewal and can use 10+GB of data. Call around if you don’t currently don’t have a contract or its finished. IF its about to finish then that is the best time to call your provider and see what they can do for you. If you hear of a deal with another provider, your existing one will usually match or better the offer. Its also not a bad idea to periodically call in and see about any deals available. Like 2 free GB, free phone upgrade etc. All carrier occasionally run decent promos. It’s high on the list of priorities because phone and visa affect your credit in an immediate way, so make sure to always pay your balance off on time.

Cable or TV Streaming. Netflix, Amazon Prime TV, Apple TV, Tubi, Disney etc. This can vary widely so you decide how much goes towards TV.

Visa. If you carry a balance, you will have a minimum payment to make in addition to the interest and other fees. Would be best to alleviate this entirely but if its not possible, make sure to pay your minimum plus interest. Call your bank to get a lower interest rate too if you have a 19% card and generally carry over from last month. One of their lowest is 11.5 for low interest credit card. Or see if its best that you get a line of credit to consolidate your debt under a much lower interest payment, generally hovering around 3%.

Gym. You typically know the amount each month so it can go under fixed. In the city this will likely run you around $100 a month, with some premium gyms or niche studios being closer to $300 and other chain gyms like Goodlife running you around $50.

Savings or Investments Contributions. Unless you’re in the deep end with debt, committing to small but regular contributions for your TFSA, RRSP or other investment vehicle will leave you ahead of the curve down the line. You will thank yourself for investing in your future. Unless you bought weed company shares recently, in which case you are sitting on it for the indefinite future, hoping it wont implode. Story for another day. A small 50 dollar automatic withdrawl each month is a good amount that you wont ‘feel’, and can forget about, then be pleasantly surprised later on when you see small gains. These contributions should be to ‘safer’ type investments like mutual funds, money market, bonds and the like. You don’t need to get into options or high risk securities here unless you know what you are doing. And if you did, then you would already know this tidbit. This is particularly important to do if your employer doesn’t already have an established Corporate Pension Plan like a Defined Benefits of Defined Contribution program, where a small percentage of each pay goes towards the pool and is matched exceeded by your employer. Most large, government or quasi government employers will take care of this, but if you are in the private sector, see to it that you take care of it. Maybe they have stock options, maybe you have to open a separate self directed investment account via your bank or brokerage firm. Don’t leave this alone, do it soon as you get regular income.

Other. Do you have other subscriptions like a quarterly magazine, or music streaming like Spotify? Put these here.

SPENDING

Needs to Spend On

Food 1- This is meant for what you need to stay alive and not your outings which falls under food 2. Here you have to determine if you will get groceries or obtain a monthly food subscription to the likes of meal prep Programs or both. For example Mama Earth Organics delivers fresh farm produce to your door weekly and focuses on meatless items. TruLocal is a meat delivery program that sources the best cuts from Local or localish sources (in the case of their seafood). MealPal caters to those working in the core at lunch times. HelloFresh and Goodfood promises to turn any weeknight meal into an easy step by step process with all necessary ingredients included in your weekly box. The prevalence of these is rapidly increasing and you have to determine what is right for you. Is it better to simply do a monthly Costco run and meal prep yourself on Sunday? Then do that. This is the staple food category and should be the main food expense. 150 a week is probably average for what should be spent. I also throw in supplements to this category rather than food 2 as I find it a personal service you do to yourself when you regulate and balance your body with <some> supplements.

Pets. Please refer to “Before you get a dog” post if you haven’t already burdened yourself with getting a pet. If it’s too late, have a separate category for your little fur baby including food, vet bill, toys and equipment, groomer, dog walker and insurance, which you really should have for little Cujo. Just in case put ‘other’ for when you need to find a kennel while you’re traveling or a friend to pay for dog sitting. A fish is easier, but I guess most Torontonians have either a dog or a cat.

The B Word. Babies. This will rank higher on the list if you actually have a baby, but I’ve placed it near the bottom of the list under spending because most people in the city have not yet had a babe or are on their way out of the jungle with their new addition. Maybe your tots are grown or you just don’t want kids. Didn’t want to loose you at “babies”. Refer to “when city dwellers have babies” for an elaboration to this effect if you find it applicable. Baby costs are not SO bad but will affect most areas of your budget. To keep it simple this post assumes no children.

Wants to Spend On

Personal. Clothes/Makeup/Shoes/Accessories/Body. This is self explanatory. Things for yourself that are periodic costs, which shouldn’t blow your budget and is only intended for after you’ve taken care of the above essentials. Includes hygiene items like soap and feminine products, skin creams and perfumes only because there is nowhere else to put it, even if things like soap are a necessity. Organic goats milk soap from a niche boutique vegan cosmetics store is going to cost 20 times more than Shoppers soap, so this is a varying cost. Other self care items are listed in another category.

Custom Jewellery. As we get older and are in the city earning a decent income, jewellery is something pretty much necessary. Every woman should have at least one staple set of diamond studs, Says I, or a unique piece that is representative of themselves. Fashion jewellery doesn’t count. You should think about custom Fine Jewellery, again if you have a bit of discretionary income to upgrade yourself from the teenage you that ran around with a rubber “livestrong’ bracelet. Buy it for yourself or someone important in your life, ooor convince your partner its totally necessary, whatever! You deserve a treat here and there. And I don’t care how ‘in’ the homeless look is, jewellery is something absolutely everyone can appreciate given that it is a match to their unique style. You’re best off going to a place that can create whatever vision you have knowing you will not end up with junk that is mass produced overseas. A custom studio will work with you to render what you want, exactly how you want, and typically will work within your budget. So while its not the cost of an retail store charm bracelet, it is not as costly as you might imagine your perfect, precise and unique piece to be.

Home Goods. A weekly Cleaner, as well cleaning products, furniture and other decorative or functional purchases. Anything that you buy for your surroundings that don’t include your physical self. They are numerous so I kept this as a separate category because it accumulates rapidly. Everything from dishware to towels, bed linens, light bulbs, swiffer pads, speakers, you know, stuff.

Food 2. This is for you if you’re living more flush and/or want to get fat. Uber eats, Foodora, sit down restaurants, underground concourse pick up, fast foodtruck lunches and caca food purchased at a premium during events such as beer fest, CNE, Leafs or Raptor games. Etc. When people start dating they typically do this a lot, so check yo self before you wreck yo self. And If you’re making more LCBO runs than you like or find drinking is part of something you do with a lot of meals, make a separate category. I quit drinking and it’s amazing how much I’ve saved.

Side Hustle. Are you working on a side project which you hope becomes profitable, but for now remains an expense? If you have an entrepreneurial spirit then chances are this is a big cost in its startup phase, and capital should be set aside for this venture until you get some real return.

Spa. I don’t just mean for massages or physio which is usually reimbursable through most employers. I mean anything that you do for “self care” beyond wellness retreats and salt caves. For the ladies – Get micro blading every now and then? Eyelash or hair extensions? Filler, or a slew of fat burning treatments like body contouring, infra red sauna, laser, colonics, body wraps, meso, cryotherapy and so on. Don’t forget tanning, mani pedi, hair salon for cut and colour that usually run in the hundreds and things like skin treatments or other medical aesthetics such as microdermabrasion that cost out of pocket… chances are if you’re a young singleton in the city you do at least one of those things at least once a month. But that can be your little secret disclosed on your budget page as simply “spa”.

Entertainment. Can also be known as Activity/Experience/Travel, above and beyond going out for drinks. Unique things to do will be placed here, like tickets to a show, passes or entrance fees to events etc.

Hobby. Do you do something that if of interest to you for personal enjoyment and it requires money? Maybe you paint and need supplies, or are into cycling and need equipment and memberships/lessons. I keep this as a separate category to gym because it is something I view as ‘leisure’ activity which may be consistent or not.

Other Spend. One time or occasional items such as gifts, dry cleaning (if you do this regularly then move it up the list) or unforeseen expenses. I also place donations in this category, though these are tax deductible. Meaning you get it back in your tax return. This is a good strategy to implement near year end, but that is for a different post. I also include things like Amazon Prime subscriptions in this category, because its annual, and where else really to put it?

Other Income. I place this at the bottom of the list because psychologically its good to be in the habit of not expecting these periodic injections of capital. Maybe you get a bonus, your parents give you money or you make commissions. Maybe you’re an AirBnB host and sometimes get money from this endeavour. Since these are ‘extras’, meaning above and beyond your regular set income, it should not be something to rely on consistently. Investment Gains are also factored in here because its typically once where you sell a stock position and realize a profit. Bear in mind you will have to pay capital gains tax on this, as well this should never be relied upon for your living expenses. You will end up emotionally investing and this would be the beginning of a slippery slope downwards.

I hope this has been helpful in some minor way to you. Its tough to navigate Money, and they don’t teach it in schools nearly enough. It is also meant to reduce anxiety and you will find once you’ve done it once, it really becomes a stress release. I in fact get jolly when it’s time to budget because I can start to see progress, where I need to exercise more control, and what I need to do for my life plans. Don’t begrudgingly do it, instead make a ritual of it on the Sunday before the first, just as you might do meal planning. This is for your financial health, so Happy Budgeting!

10 thoughts on “Financial Literacy: Budgeting for the City Dweller”

Comments are closed.

Great content! Super high-quality! Keep it up! 🙂

You completed several good points there. I did a search on the matter and found a good number of folks will consent with your blog. Wenonah Hewitt Cresida

After looking at a handful of the articles on your web site, I seriously appreciate your technique of blogging. I bookmarked it to my bookmark site list and will be checking back in the near future. Please visit my web site too and tell me how you feel. Adrea Noah Chatterjee

Interesting blog! Is your theme custom made or did you download it from somewhere? A design like yours with a few simple adjustements would really make my blog stand out. Please let me know where you got your design. With thanks Ezmeralda Lanny Maite

Magnificent beat ! I wish to apprentice while you amend your web site, how could i subscribe for a blog web site? The account aided me a acceptable deal. I had been a little bit acquainted of this your broadcast offered bright clear concept| Chelsey Theodoric Alta

Hey, thanks for the blog post. Much thanks again. Want more. Caren Wittie Rapp

Hey There. I found your blog using msn. This is a really well written article. I will make sure to bookmark it and return to read more of your useful information. Thanks for the post. I will definitely comeback. Thomasa Andrey Beckman

Thanks a lot for the post. Thanks Again. Really Cool. Jesse Vail Ferrand

I real happy to find this site on bing, just what I was looking for : D as well saved to fav. Nessa Antoine Ancalin

Simply wanna remark that you have a very decent web site , I enjoy the design it actually stands out.